1. Market review this month: The domestic soda ash market was under pressure and declined in March

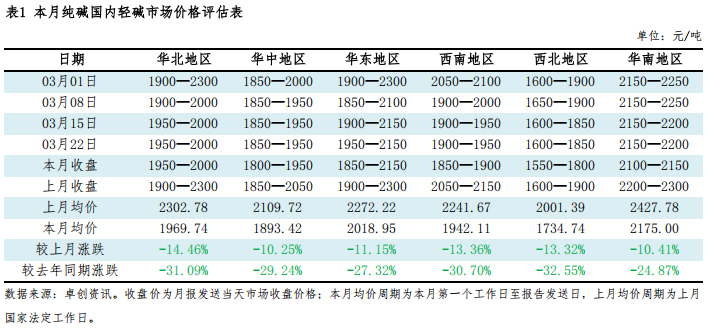

As of March 27, the mainstream ex-factory price of light alkali of domestic soda ash manufacturers is 1,800-2,000 yuan/ton, and the average ex-factory price of light alkali is 1,885 yuan/ton, down 8.0% from the average price on February 27, the decline narrowed slightly from the previous month; as of March 27, the domestic mainstream terminal price of heavy alkali was 1,900-2,100 yuan/ton, down 8.8% from the price on February 27.

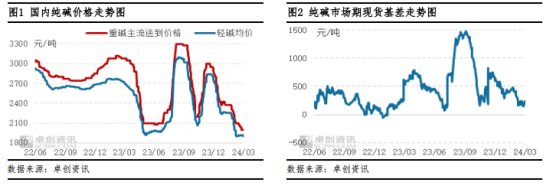

The March futures price continued to decline after rebounding, the spot price of heavy alkali continued to decline, and the basis weakened.

2. Analysis of driving factors: In March, the domestic soda ash market fluctuated downwards, and the focus of market transactions shifted downwards.

The light alkali market fell first and then stabilized, while the heavy alkali market declined weakly. After the price of soda ash fell in the first half of the year, downstream users concentrated on replenishing goods. Coupled with the increase in market prices, downstream users and traders of light alkali became more enthusiastic about purchasing goods. The shipment situation of light alkali has improved, and some soda ash manufacturers have raised their light alkali prices by 50-100 yuan/ton in the middle of the year. In the second half of the second half, downstream users mainly purchased for urgent needs, and the situation of new orders was average. Some soda ash manufacturers' light alkali prices fell by about 50 yuan/ton. The supply remains at a high level, with downstream float glass and photovoltaic glass manufacturers mainly purchasing on demand. In addition, imported goods have arrived at the port, and downstream users have continued to lower prices. Heavy alkali prices have continued to fall. In March, the mainstream ex-factory price of light alkali dropped by 100-200 yuan/ton, and the mainstream terminal price of heavy alkali dropped by 150-200 yuan/ton.

3. Related products: Float glass market operation situation

As of March 27, the national monthly average float glass price in March was 1,934.45 yuan/ton, a month-on-month decrease of 6.08%. The month-on-month increase turned to a decrease, and the year-on-year increase was 9.29%. Glass market prices declined weakly in March, competition pressure increased, and regional price differences narrowed. Due to the relatively large increase in production capacity in the southern region during the year, the price decline in the southern region during the month was generally greater than that in the northern region, and the price difference between the north and the south regions narrowed significantly. During the month, terminal startup was slow and orders were not actively placed. As a result, most downstream processing plants were short of orders. At the same time, float production capacity was at a high level, and the contradiction between supply and demand was severe. During the month, the middle and lower reaches mainly digested their own supply. The production and sales of float plants continued to be low, and prices were pressured downward. Looking at next month, demand is expected to recover, but under high supply pressure, we still need to wait and see the strength of demand. At present, it may be difficult to increase demand in a concentrated manner, and the supply and demand structure may be difficult to reverse for the time being. Production capacity remained high during the month. As of the end of March, it is estimated that there are 312 float glass production lines nationwide, 259 are in production, and the daily melting capacity totals 176,465 tons, a decrease of 100 tons from the previous month and a year-on-year increase of 9.21%. During the month, one production line was newly fired up, one was cold repaired, and five lines were converted into production, three of which were converted from white glass to colored glass or ultra-white.

4. Future market outlook: market prices may first decrease and then increase.

Market analysis in the next three months: both supply and demand will increase, and the increase in supply is expected to be greater than the increase in demand. On the supply side, as the price difference between domestic and foreign countries narrows, import volume is expected to decrease after April. The 300,000-ton unit in Fufeng in Northeast China has plans to put into production. The domestic maintenance plan is still relatively limited, and the supply of goods is expected to be relatively sufficient. On the demand side, soda ash demand is expected to improve slightly. In the second quarter, some photovoltaic production lines are still planned to be ignited, and the consumption of soda ash continues to grow. However, the float glass production capacity has remained at a high level recently, and the supply pressure is relatively high. In the second quarter, some installations have cold maintenance plans, and the consumption of soda ash may be reduced. The overall increase in demand for light alkali downstream may be relatively limited, and the consumption of soda ash remains stable. Supply pressure is expected to remain in the next three months, and the center of gravity of market prices may still shift downward. The market has a strong wait-and-see sentiment, and downstream users mostly purchase on demand. Soda ash prices are expected to be weak in April. With the decline in soda ash prices from May to June, the profitability of soda ash manufacturers has deteriorated, and with the successive announcement of maintenance plans, there is a possibility that prices will stabilize and rebound. The average price of heavy alkali from April to June is expected to be 1,900 yuan/ton, 1,900 yuan/ton, and 1,950 yuan/ton.

Fundamentals of supply and demand in April: China Salt Kunshan, Henan Junhua, and China Salt Red Sifang soda ash plants are expected to be shut down for maintenance in April. The industry's operating load may drop slightly, but the supply may still be sufficient. Photovoltaic production lines were still on fire at the end of March. Soda ash consumption continued to grow in April. The float glass market continued to decline. Some production lines have cold repair plans in April. The downstream demand for light alkali is expected to change little, with soda ash mainly purchased on demand.

Currently, soda ash manufacturers have relatively limited orders to ship in April. Although some manufacturers have maintenance plans, domestic supply pressure may still exist, and some manufacturers are increasing their intention to accept orders. Downstream users are not very enthusiastic about stocking up and mainly purchase soda ash on demand. Traders are cautiously watching the market. The domestic soda ash spot market may be weak in April.